What is equity release?

Equity release helps you to access the cash which is tied up in your home if you are over the age of 55. That’s is you can use the money which you release as a lump sum or, in several smaller amounts or as a combination of both. Equity release is a way for homeowners to release some of the tax-free funds from their homes without having to move. It can play important role in retirement funding and without worrying about making monthly repayments. Many may avoid the equity release companies, Here in this blog let’s see the top 10 Equity Release Companies in the UK.

Equity Release Companies to Avoid

Why the below 10 are best equity release companies?

1. The Equity Release Experts

Address: The Equity Release Experts, Baines House, 4 Midgery Court, Fulwood, Preston, PR2 9ZH.

Contact: 0800 188 4812

Email: info@equityrelease.co.uk

The Equity Release Experts is a part of the Key Group, the UK’s largest provider of equity release services. This company completely operates free of charge as their usual advice fee of 1.99% of the amount released would only be payable on completion of a plan which subjects to a minimum advice plan of £1499. They’ll compare more than 300 plans from across the whole market and provide the best service for the clients.

2. Aviva

Address: Aviva PLC. Registered Office: St Helen’s, 1 Undershaft, London EC3P 3DQ

Contact: 0808 239 3096SS

Aviva offers an award-winning service that has helped over 250,000 people release more than 8 billion pounds since 1998. They paid 98% of the claims in the year 2018, so you can rely on them to help put things right when they go wrong. Aviva Investors has invested 6 billion pounds of green assets on behalf of Aviva. They developed a way to use the faster payments system for claims, which means over 4,000 will get their settlement on the same day.

3. Canada Life

Address: Canada Life Ltd, Canada Life Place, Potters Bar, Hertfordshire, EN6 5BA.

Contact: 0345 606 0708

Aviva offers an award-winning service that has helped over 250,000 people release more than 8 billion pounds since 1998. They paid 98% of the claims in the year 2018, so you can rely on them to help put things right when they go wrong. Aviva Investors has invested 6 billion pounds of green assets on behalf of Aviva. They developed a way to use the faster payments system for claims, which means over 4,000 will get their settlement on the same day.

4. One Family

One Family is a customer-owned business, which means they are able to reinvest their profits for the benefit of their customers rather than shareholders. One Family has over 2 million customers and over 7 billion pounds worth of families.

They have over 40 years of experience in this field, they invested nearly 4 million pounds to support their customers and communities since 2015 and they make responsible investments through climate-impact funds.

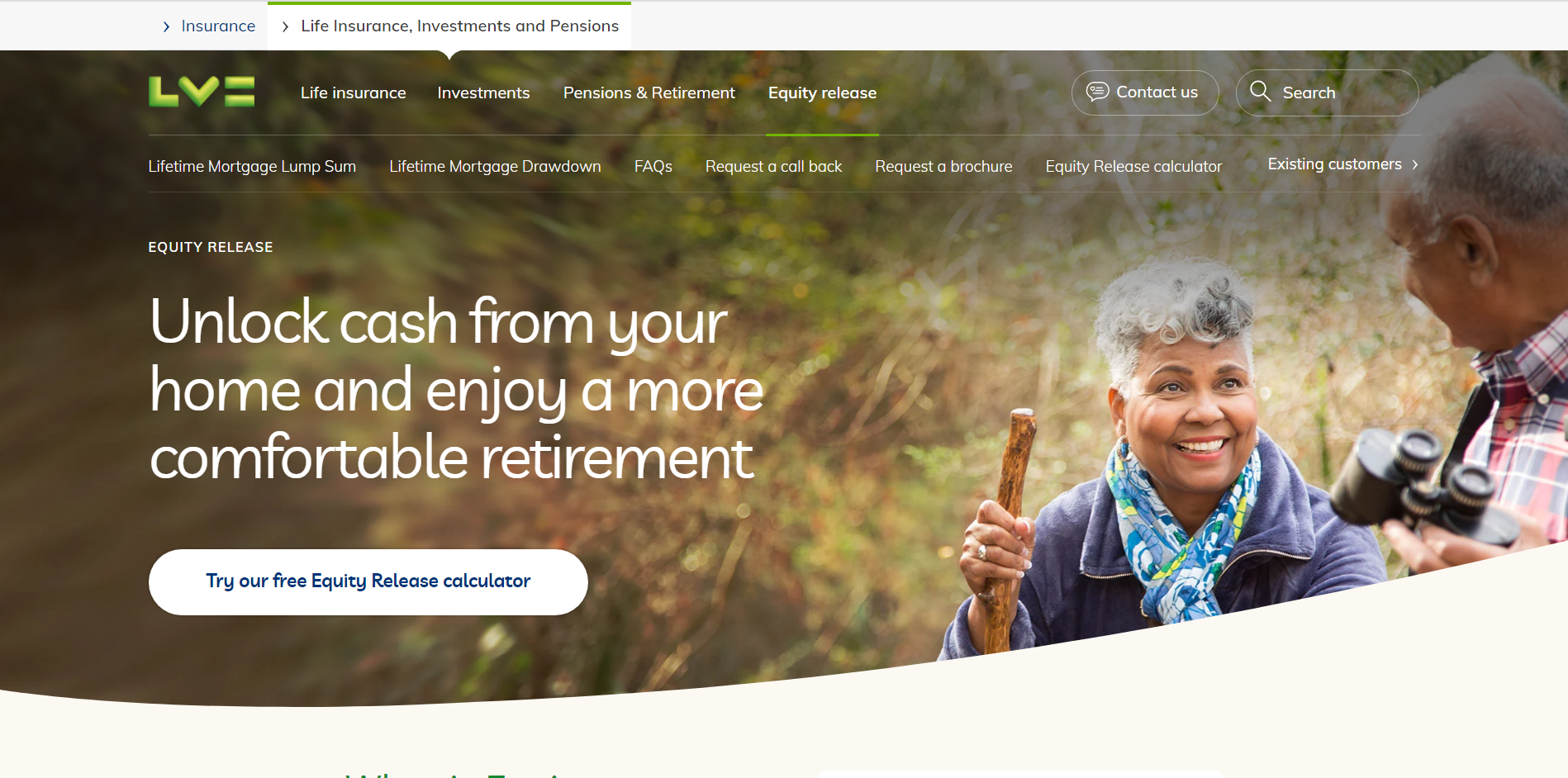

5. LV

Address: Emperor House, Grenadier Road, Exeter Business Park, Exeter, EX1 3LH.

Contact: 0800 022 3847

LV= is one of the best equity release companies in the UK which helps the customers to unlock the cash from their home asset and enjoy tax-free amount of lump sum after retirement. If you need any advice on the equity release, then you can book a free consultation with LV and their consultants will help you with the best idea to get it done.

6. Our Life Plan

Address: Our Plan Life, 2nd floor, 167-169 great Portland Street, London, UK, W1W 5PF.

Our Life Plans tries to provide as much unbiased information as possible about various retirement and end-of-life planning options in the UK. Right from will writing to funeral plans and life insurance to equity release and annuities. From time to time they make work with authorized companies and brokers who can provide the best services and which in turn may pay them a commission, but this will be disclosed and help keep this site free.

7. Legal and General

For more than 180 years they are helping their customers to get more out of life and they made it simpler to find out what you have saved and what your options might be all in one place.

Legal and General company helps to retire the old clichés and making it simpler to find everything needed for retirement. Looking for a lost pension? Their tracing and consolidation service can help you find lost pensions, and let you bring eligible pensions together into one product.

8. Retirement Bridge

Address: Retirement Bridge services, 3RD Floor, Cross House, Westgate Road, Newcastle upon Tyne, NE1 4XX.

Contact: 0800 032 2118

Email: enquiries@retbridge.co.uk

Retirement Bridge started in the year 1978. They have been committed to providing their customers with a high level of service. Retirement Bridge Management Limited is the UK’s biggest administrator of home reversion plans. This company currently manages in the region of 4,500 plans. They will give Buildings insurance, Property inspection, Declaration of occupancy, and monthly rental payment. Their plans offer up to 80% of your home’s value and include a free valuation.

9. London Equity Release

Address: Equity Release London, 3 Court Hill, London, CR5 3NQ, England.

Contact: 0800 028 3034

Email: info@londonequityrelease.com

London Equity Release is a trading style of equity release supermarket. If these are your first steps into researching whether equity release is your best opinion, then their London equity release website provides all the information you need. They take great satisfaction in building business relationships with London professionals, such as mortgage brokers, solicitors, accountants, etc.

10. Equity Release Sussex

Address: 139 Rectory Road, West Worthing, West Sussex, BN14 7PH.

Contact: 01903 809660

Equity Release Sussex is a trading style of TRM Financial Limited, an appointed representative of The Right Mortgage Limited, which is authorized and regulated by the financial conduct authority. John Whyte, he is the specialist Equity release broker in Sussex covering the whole of the UK. They’ll help you choose an equity release plan that’s right for you, leaving you to enjoy your retirement. By switching your Equity Release Plan, you may able to: obtain lower interest rates, Release more tax-free cash, save thousands of pounds, and so on.