Accessing credit can be challenging, especially for those with limited borrowing history or poor credit scores. Many traditional lenders impose high-interest rates, hidden fees, or complex repayment terms that can lead to long-term financial difficulties.

This is where Creditspring stands out as a responsible lender, offering a fixed-fee, no-interest borrowing model designed to support financial stability.

This article explores how Creditspring works, who it is for, and why responsible lending is crucial for borrowers in the UK.

What Is Creditspring and How Does It Work?

Creditspring is a UK-based lender that provides a unique, fixed-fee, no-interest borrowing model designed to help individuals access small loans without the risk of accumulating high-interest debt.

Unlike traditional lenders that rely heavily on interest rates, Creditspring operates on a membership-based model where customers pay a fixed monthly fee to access two loans per year.

How the Membership Model Works?

Instead of charging interest, Creditspring offers a simple and predictable payment structure:

- Fixed Membership Fee – Customers pay a set monthly fee to access borrowing options.

- No-Interest Loans – Members can take out two loans per year without incurring any interest charges.

- Repayment in Instalments – Each loan is repaid over six months, ensuring affordability.

- Transparent Costs – There are no hidden fees or penalties for early repayment.

This structure ensures borrowers have access to credit when they need it while avoiding the risk of spiralling debt caused by high-interest rates or unmanageable repayments.

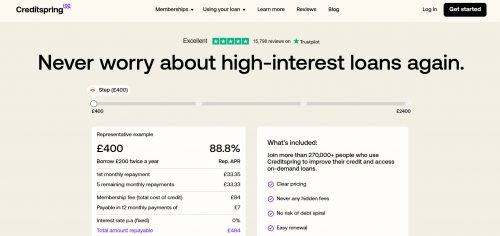

Representative Example (£400 Plan)

Step (£400) Representative Example:

| Loan Details | Creditspring Membership (£400 Plan) |

| Loan Amount | £400 (£200 borrowed twice a year) |

| Representative APR | 88.8% |

| 1st Monthly Repayment | £33.35 |

| Remaining Monthly Repayments | 5 payments of £33.33 |

| Membership Fee (Total Cost of Credit) | £84 |

| Membership Fee Payment Structure | Payable in 12 monthly payments of £7 |

| Interest Rate (Fixed, p.a.) | 0% |

| Total Amount Repayable | £484 |

| Cooling-Off Period | 14 days to change your mind for free |

| Total Repayment Duration | 13 months (including membership payments) |

| Eligibility Requirements | Loans subject to status and affordability checks |

What’s Included in the Membership?

Joining Creditspring gives you access to responsible, predictable, and stress-free borrowing, with key benefits such as:

- Clear Pricing – Transparent and fixed fees with no surprises.

- No Hidden Fees – What you see is what you pay, with no extra charges.

- No Risk of a Debt Spiral – Fixed repayments and a structured borrowing model prevent over-indebtedness.

- Easy Renewal – Continue your membership hassle-free for ongoing financial support.

Creditspring Membership Plans

Creditspring offers multiple membership options tailored to different borrowing needs. Each plan provides two fixed no-interest loans per year, ensuring predictable and responsible borrowing.

Membership Options and Loan Amounts

| Membership Plan | Loan Amount | Membership Fee | Monthly Membership Payment | Total Amount Repayable |

| Free Membership | No loans | £0 | £0 | £0 |

| Go | 2 x £200 Loans | £84 | £7 | £484 |

| Core | 2 x £300 Loans | £120 | £10 | £720 |

| Plus | 2 x £500 Loans | £144 | £12 | £1,144 |

| Extra | 2 x £1,200 Loans | £276 | £23 | £2,676 |

Key Benefits of Creditspring Membership:

- No-Interest Loans – Borrow up to £2,400 per year, depending on your plan, with 0% interest.

- Fixed Monthly Membership Fee – Know exactly what you’re paying with no hidden charges.

- Easy Repayments – Loans are repaid in six manageable monthly instalments.

- No Risk of a Debt Spiral – Transparent borrowing terms ensure financial stability.

- 14-Day Cooling-Off Period – Cancel your membership for free within 14 days if you change your mind.

Creditspring is designed to help you access credit responsibly while building financial resilience and avoiding high-interest debt.

How Creditspring Loans Can Be Used?

Creditspring’s fixed-fee, no-interest loans provide financial flexibility for various personal needs. Whether you need funds for unexpected expenses, planned purchases, or financial emergencies, Creditspring offers a responsible and predictable lending solution.

1. 12-Month Loans: Creditspring memberships last for 12 months, with structured repayments, making it a reliable alternative to traditional long-term loans.

2. Direct Lender Loans: Unlike brokers, Creditspring is a direct lender, meaning you apply directly with them without third-party involvement.

3. London Loans: Available to all UK residents, including those in London and surrounding areas, Creditspring provides a hassle-free way to access funds.

4. Holiday Loans: Need extra cash for a vacation? Creditspring’s no-interest loans help you manage travel expenses without high-interest credit card charges.

5. Online Loans: The fully digital application process ensures a seamless borrowing experience, with fast approval and instant access to funds.

6. Unsecured Loans: All Creditspring loans are unsecured, meaning you don’t need to provide collateral, unlike traditional secured loans.

7. Instalment Loans: Each loan is repaid in six fixed monthly instalments, allowing for manageable and predictable payments.

8. Loans for Bad Credit: Creditspring’s eligibility criteria focus on affordability rather than just credit scores, making it a suitable option for borrowers with limited or poor credit history.

9. Emergency Loans: For unexpected expenses such as medical bills, urgent home repairs, or last-minute travel, Creditspring provides quick access to funds with zero interest.

10. Wedding Loans: Planning a wedding? Creditspring helps cover costs without the burden of high-interest borrowing.

11. Personal Loans: Use your Creditspring loan for general personal expenses, whether it’s funding a new project or making everyday purchases.

12. Loans for the Short Term; Unlike payday loans that require full repayment on your next payday, Creditspring loans are repaid in six structured instalments, making them a more manageable option.

13. Loans for Car Repairs: Unexpected car breakdowns can be costly. Creditspring offers a quick way to cover repair costs without relying on high-interest credit cards or payday loans.

14. Small Loans: Borrow as little as £200 with the Go membership—ideal for small, short-term financial needs.

15. Payday Loans Alternative: Unlike payday loans, which can trap borrowers in a cycle of debt, Creditspring provides a safer, interest-free alternative with fixed monthly fees.

16. Christmas Loans: Spread out the cost of holiday shopping and festive expenses with Creditspring’s flexible repayment structure.

17. No-Interest Loans: Creditspring never charges interest, making it a transparent and affordable borrowing option.

18. Home Improvement Loans: Need to renovate or repair your home? Creditspring loans help finance home improvement projects without costly credit.

Why Choose Creditspring for Your Borrowing Needs?

- No-interest loans with a fixed membership fee

- Predictable repayments with no hidden charges

- Quick and easy access to funds when you need them

- Eligibility based on affordability, not just credit scores

- Flexible borrowing for a range of financial situations

With Creditspring, borrowing is simpler, safer, and more responsible, providing financial support when you need it most.

Why Is Responsible Lending Important for Borrowers?

Responsible lending is crucial in ensuring that borrowers do not fall into financial distress due to excessive interest rates, hidden fees, or unsuitable credit agreements. Many people in the UK struggle with high-cost credit options that make repayment difficult, leading to financial hardship and poor credit scores.

How Creditspring Promotes Responsible Lending

Creditspring is committed to responsible lending through various measures:

- No Interest, No Hidden Fees – Unlike payday loans and credit cards, Creditspring does not charge interest, which reduces the overall cost of borrowing.

- Fixed, Predictable Costs – Since members pay a flat monthly fee, they know exactly how much they will be paying, making budgeting easier.

- Affordability Checks – Creditspring assesses borrowers based on affordability rather than just credit scores, ensuring they can repay their loans without financial strain.

- Credit-Building Opportunities – On-time repayments help borrowers build or improve their credit scores, providing better financial opportunities in the future.

By ensuring borrowers can repay their loans comfortably, Creditspring helps prevent financial distress and promotes healthier financial habits.

Who Can Apply for a Creditspring Membership?

Creditspring is designed to be accessible to a wide range of borrowers, including those who may struggle to obtain credit from traditional lenders. While it is not a guaranteed approval service, its affordability-focused approach makes it a more inclusive option.

Eligibility Criteria:

To qualify for a Creditspring membership, applicants must meet the following requirements:

- Be at least 18 years old

- Be a UK resident with a UK bank account

- Have a stable source of income

- Pass Creditspring’s affordability assessment

Unlike many traditional lenders, Creditspring does not solely rely on credit scores to determine eligibility. Instead, it considers an applicant’s overall financial situation to ensure the loan is suitable and manageable.

How Does Creditspring Compare to Traditional Loans?

Traditional loans, payday lenders, and credit cards often come with high-interest rates, hidden fees, and complex repayment structures, making them riskier for borrowers. Creditspring, on the other hand, offers a simpler and more predictable alternative.

Comparison Table

| Feature | Creditspring | Traditional Loans |

| Interest Charges | No interest | Varies (often high) |

| Hidden Fees | None | Possible |

| Repayment Terms | Fixed 6-month instalments | Varies, may be longer |

| Impact on Credit Score | Can help improve if paid on time | Can harm if mismanaged |

| Eligibility Focus | Affordability-based | Credit score-dependent |

The key advantage of Creditspring is that borrowers do not pay interest and always know their total cost upfront, eliminating the unpredictability that comes with high-interest loans.

What Are the Benefits of Using Creditspring for Borrowing?

Creditspring offers several advantages that make it a preferred choice for borrowers looking for responsible lending options.

1. Predictable and Transparent Costs: With no interest and no hidden fees, Creditspring ensures that members always know what they are paying for. The fixed monthly membership fee covers borrowing costs, making it easier to budget and plan finances.

2. No Risk of a Debt Spiral: Many traditional loans and credit cards lead to long-term debt due to compound interest and revolving credit limits. Creditspring eliminates this risk by providing clear repayment terms and fixed borrowing limits, preventing borrowers from accumulating unmanageable debt.

3. Credit Building Benefits: Repaying Creditspring loans on time can help improve an individual’s credit score, making it easier to access better financial products in the future. Since Creditspring reports repayment history to credit reference agencies, responsible borrowing can enhance creditworthiness over time.

4. Member-Exclusive Benefits: Beyond loans, Creditspring offers additional financial tools and money-saving opportunities, including:

- Financial Stability Score – A unique measure of an individual’s financial resilience.

- Spending Insights – Personalised tools to help users manage their finances effectively.

- Partner Offers – Discounts and deals from financial service providers to help members save money.

These features go beyond lending and focus on long-term financial well-being.

How Can Creditspring Help Improve Your Credit Score?

For individuals looking to build or improve their credit score, Creditspring can be a useful tool. Unlike payday loans or high-cost credit cards, which can negatively impact credit if mismanaged, Creditspring is designed to help borrowers develop responsible borrowing habits.

Ways Creditspring Supports Credit Improvement:

- On-Time Repayments – Completing loan repayments on schedule helps demonstrate financial responsibility.

- Regular Borrowing Activity – Using Creditspring responsibly can help build a positive credit history over time.

- No Risk of Over-Borrowing – Fixed borrowing limits ensure users do not take on excessive debt that could damage their credit score.

Since Creditspring reports repayments to credit agencies, responsible usage can have a positive long-term impact on an individual’s credit profile.

What Are the Alternatives to Creditspring?

While Creditspring is a strong choice for responsible lending, there are other alternatives worth considering:

Credit Builder Credit Cards

- Suitable for individuals looking to improve their credit score.

- Usually has low credit limits and high-interest rates if balances are not cleared monthly.

Credit Unions

- Offer low-interest loans to members.

- More flexible and community-focused lending.

Personal Savings

- Encourages financial independence.

- Helps reduce reliance on borrowing for emergencies.

Salary Advance Services

- Some employers provide early access to earned wages before payday.

- Can help manage short-term financial shortfalls.

Each alternative has its own advantages and limitations. The best option depends on an individual’s financial situation, borrowing needs, and credit goals.

Conclusion

Creditspring provides a responsible and transparent borrowing option for UK residents. Its membership-based, no-interest model ensures borrowers avoid high-interest debt while building their financial stability.

With a clear application process, structured repayments, and added financial tools, Creditspring stands out as an ethical alternative to traditional lending.

Before applying, consider your financial situation and explore all available options to ensure responsible borrowing.

Conclusion

Creditspring provides a responsible and transparent borrowing option for UK residents. Its membership-based, no-interest model ensures borrowers avoid high-interest debt while building their financial stability. With a clear application process, structured repayments, and added financial tools, Creditspring stands out as an ethical alternative to traditional lending.

Before applying, consider your financial situation and explore all available options to ensure responsible borrowing.

FAQs About Creditspring and Responsible Lending

Is Creditspring a payday loan provider?

No, Creditspring is not a payday lender. It offers membership-based, no-interest loans with fixed repayments over six months.

Will applying for Creditspring affect my credit score?

Checking your eligibility does not impact your credit score. However, missing repayments can negatively affect it.

Can I borrow more than two loans per year with Creditspring?

No, Creditspring currently limits borrowing to two loans per year under its membership model.

What happens if I cannot make a repayment?

If you are struggling to repay, contact Creditspring’s support team immediately. Late or missed payments can affect your credit score.

Does Creditspring charge any hidden fees?

No, Creditspring operates on a fixed-fee model with no hidden charges.

How long does it take to get my loan?

Once approved, funds are usually available within a few hours.

Can I cancel my Creditspring membership?

Yes, you can cancel within the 14-day cooling-off period without any charges. After that, standard terms apply.